IPO Advisory

Our services help companies to leverage the vast landscape of Capital Markets/ Global funds. We make companies IPO ready, guide them through every step from planning, compliance, fundraising strategies, brand positioning for maximum investor interest.

India's IPO Market Growth And Future Prospects

India’s capital markets are the center-stage of global financial activity. IPO market is growing at a scorching pace, fueled by a strong economy and investor confidence, positioning India as a global economic powerhouse. Here’s a quick look at its future and role in growth:

- Over ₹4 lakh crores have been raised through IPOs since 2019.

- About 20 crore investors make this financial transformation possible.

- Capital Markets are growing at a rate of CAGR 14%.

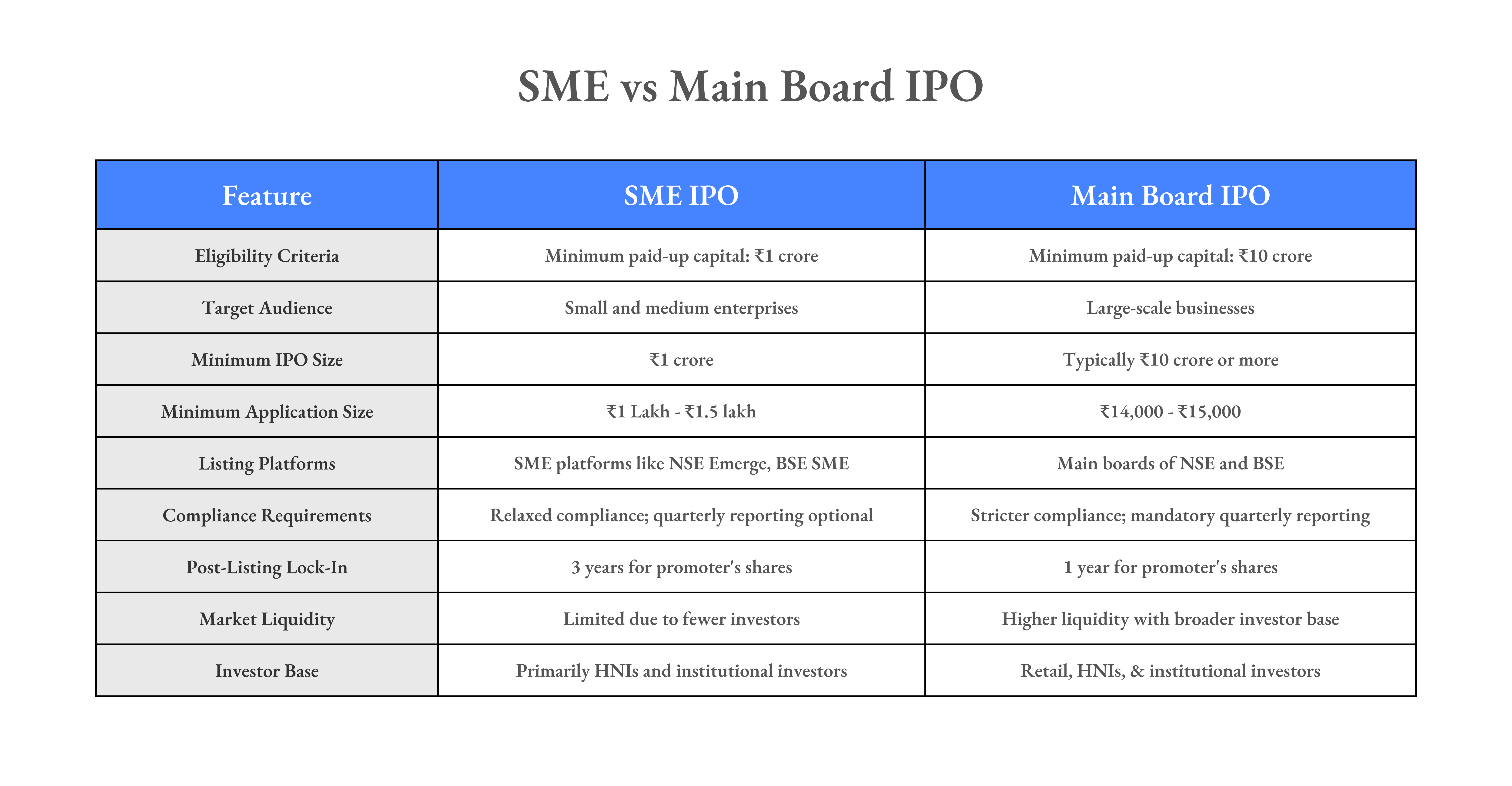

- Exclusivity Through NSE Emerge & BSE SME Platforms

- India’s economy expected to grow at 6-7% annually.

- IPOs help create jobs and raise capital for infrastructure.

- 400 million more people joining India’s middle class by 2030.

- ₹1 lakh crore in IPOs expected in the next few years.

- India’s startup ecosystem is booming, with many unicorns.

- Stable govt & Reforms making it easier for companies to go public.

Benefits of Listing

Listing a company on the stock market provides access to capital for growth, enhances credibility and visibility, improves liquidity for shareholders, and allows broader ownership, fostering long-term business stability.

Shareholder’s Wealth Maximization

Along with Promoter’s Wealth, Listing on the bourses will also provide for shareholder's wealth maximization.

Listing Enables Exit via OFS

A listed entity provides platform to existing/strategic investors to offload their shares through Offer for Sale (OFS) mechanism.

Launchpad for raising further capital

Facilitates fund raising in future via Private Placements, Rights Issue, Preferential Issue, etc

Recognition of Brand & Company

Listing facilitates visibility of the Company/ brand and creates sustainable competitive advantage in the long run.

Liquidity and Transparency

Listing provides liquidity to the shareholders. It also provides immense credibility to all the shareholders

Industries we have served

We offer comprehensive IPO advisory services to help businesses successfully navigate the IPO process. Our expert team provides tailored strategies to raise capital, attract investors, and ensure a seamless listing, supporting your company’s growth and expansion at every stage.

Let’s Go Public

WHY CHOOSE US ?

Complete IPO Support

Handholding companies from inception. From planning & understanding promoter psyche to showcasing the business to the investor community to a successful listing on the bourses.

Smart Fundraising Strategy

Optimize valuation through scrupulous first level due diligence, to ensure the valuation is apt for the promoters vision/ investors and regulatory approvals from SEBI. Create long-term value for the promoters &shareholders.

Regulatory Compliance

For smooth sailing we ensure all the company operations/ financials etc are fully compliant & in adherence with SEBI/ NSE/BSE. We help the companies to set up global processes to ensure clearance in shortest timeframe

Strong Market Positioning

Positioning the company in the right bracket for enhanced brand visibility, credibility, and investor interest. This helps in getting the right kind of investors who help the company to achieve its short and long term objectives

FAQ/s on IPOs

An IPO (Initial Public Offering) is when a company offers its shares to the public for the first time. It allows your business to raise capital, enhance brand visibility, and provide liquidity to existing shareholders.

Our IPO advisory helps you navigate the entire IPO process—from regulatory compliance and market analysis to investor relations and pricing—ensuring a successful public offering.

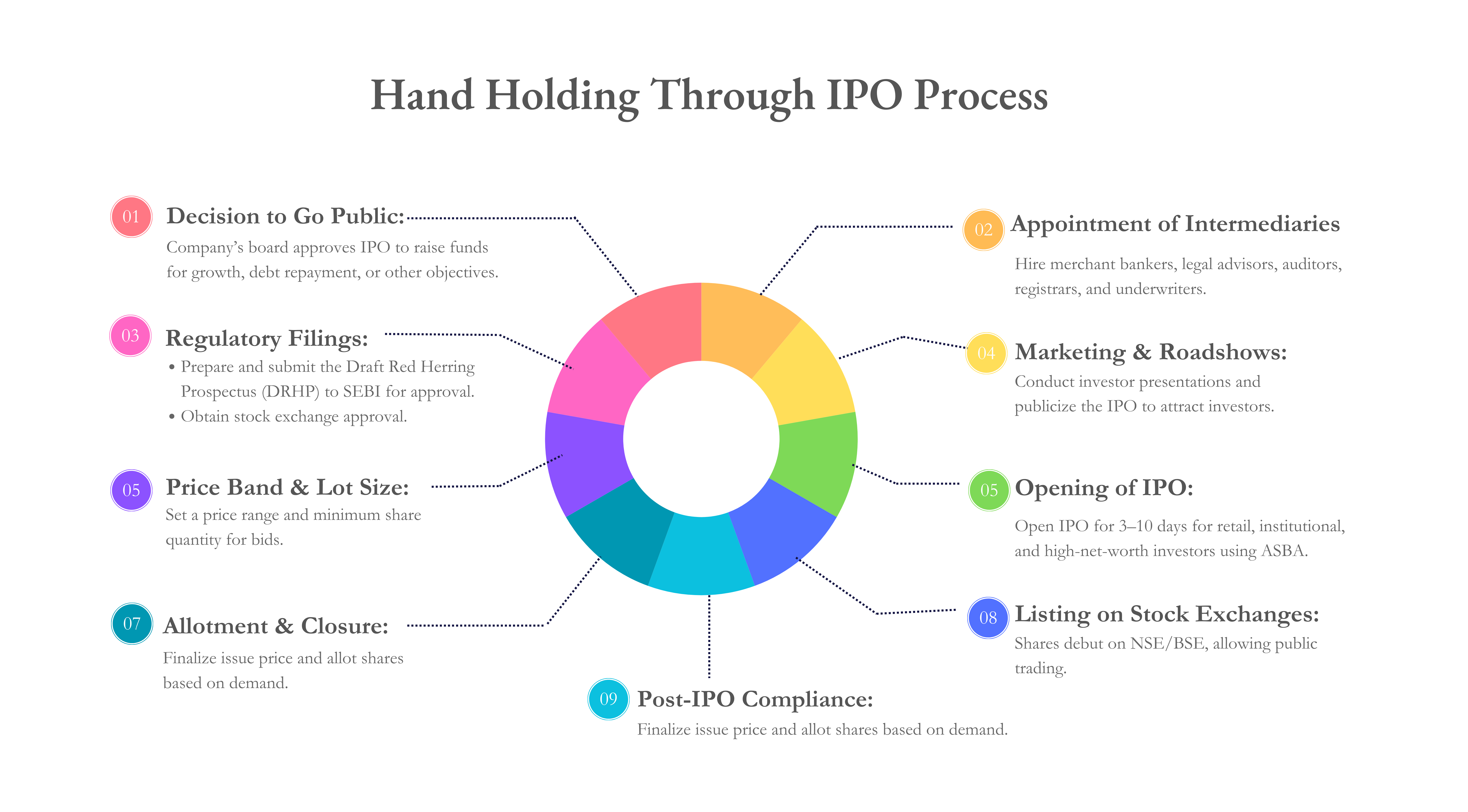

The key steps include selecting advisors, conducting due diligence, preparing the prospectus, pricing the shares, marketing the offering, and listing on the stock exchange. We guide you through each phase to ensure smooth execution.

We analyze market conditions, industry benchmarks, company performance, investor sentiment business valuation matrix to determine an optimal pricing strategy that maximizes capital raised while ensuring investor interest.

Regulatory requirements include preparing detailed financial disclosures, submitting a prospectus to regulators, and meeting listing standards set by the stock exchange. We ensure your compliance with all regulations.

We assess your company’s financial health, corporate governance, and operational structure, providing recommendations to align with market expectations and regulatory standards to ensure a successful IPO.

We target HNI’s/ Ultra HNI’s, Family offices, AIF’s, institutional investors, as well as retail investors who are looking for new investment opportunities in a growing company.

After the IPO, we help manage post-listing activities like investor relations, shareholder communication, and stock performance monitoring to ensure long-term success in the public market.

Schedule Your Appointment Today

Subscribe Now

Don’t miss our future updates! Get Subscribed Today!

©2025. Enoch Intermediaries. All Rights Reserved.